The Dynamic World of Ruthenium and Iridium: A Price Trend Analysis

This guide explores the complex market dynamics of Ruthenium and Iridium. Both are vital platinum group metals (PGMs). Their unique properties make them crucial for various industries.

The analysis covers their industrial significance. It also examines factors influencing their market value. This information is essential for investors, industrial buyers, and researchers. Understanding Ruthenium price trend and Iridium price trend is key in the precious metals market.

It provides a comprehensive market analysis of these important PGM raw materials.

Understanding Ruthenium and Iridium: Essential Precious Metals

Understanding these metals is crucial before analyzing price trends. This section defines Ruthenium and Iridium. It outlines their unique physical and chemical Ruthenium properties and Iridium uses.

Their primary applications span various industries.

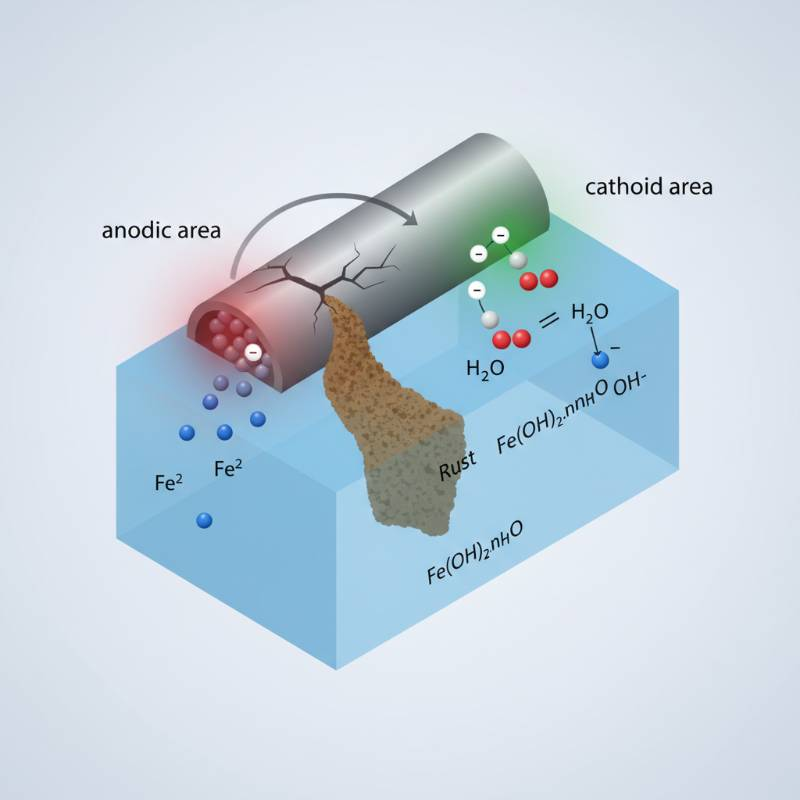

What is Ruthenium? Ruthenium (Ru) is a hard, brittle, silvery-white metal. It belongs to the platinum group. It is extremely rare. Ruthenium is known for its catalytic properties and resistance to corrosion.

What is Iridium? Iridium (Ir) is the most corrosion-resistant metal. It is also the densest natural element. Iridium is very hard and brittle. It is silvery-white and a member of the platinum group metals.

Both metals are highly valued for their specific characteristics. These include exceptional hardness, high melting points, and catalytic activity. Such qualities make them indispensable.

A Look Back: Historical Price Performance of Ruthenium and Iridium

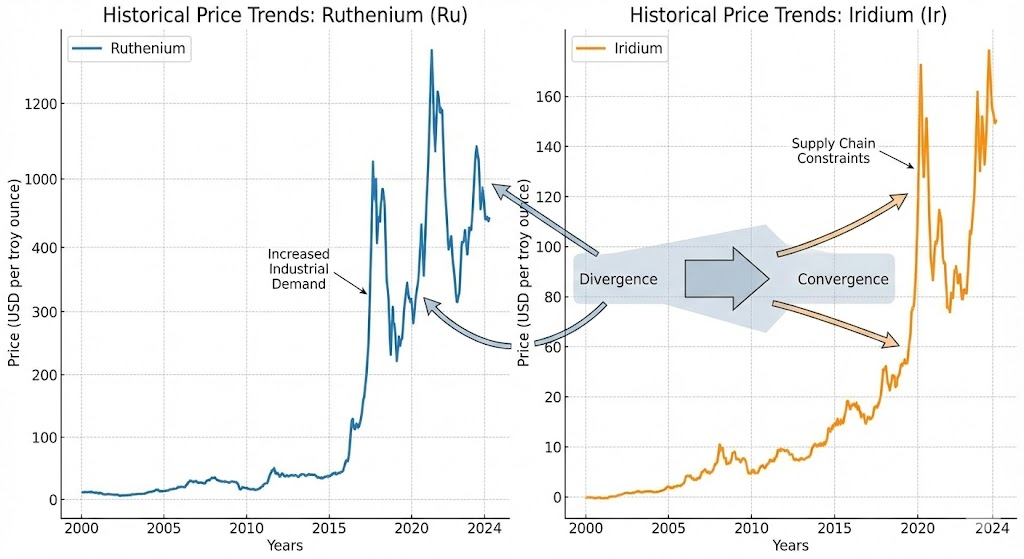

The Ruthenium historical price and Iridium historical price reveal significant volatility. Price movements over decades show distinct peaks and troughs. Various economic, geopolitical, and technological events shaped these market values.

Understanding this PGM price history is vital. It helps in assessing future market volatility analysis.

For instance, Ruthenium saw a dramatic price increase in the late 2010s. This was due to heightened demand from the electronics sector. Iridium experienced similar spikes. This occurred when new industrial Iridium uses emerged.

| Year | Ruthenium Avg. Price (USD/oz) | Iridium Avg. Price (USD/oz) | Key Market Event |

|---|---|---|---|

| 2008 | $150 | $450 | Global Financial Crisis impact |

| 2018 | $250 | $1,400 | Increased demand for electronics (HDD) |

| 2021 | $700 | $6,000 | Supply chain issues, speculative buying |

Unpacking the Drivers: What Influences Ruthenium and Iridium Prices?

The prices of Ruthenium and Iridium result from a complex mix. Supply and demand factors heavily influence their market value. This section dissects the core elements that drive these PGM market influences.

Factors range from mining output to industrial consumption. Investment sentiment also plays a significant role.

The Supply Chain: Mining, Production, and Geopolitical Stability

Global PGM supply chain for Ruthenium and Iridium is concentrated. Major producing regions include South Africa, Russia, and Zimbabwe. Ruthenium mining and Iridium production face unique challenges.

These include deep mining, high energy costs, and labor disputes. Geopolitical events also impact production and availability. Trade policies can significantly affect metal prices globally. For example, disruptions in South Africa PGM mining can have widespread effects. Statista provides data on leading PGM-producing countries.

Driving Demand: Industrial Applications and Investment Interest

Diverse industrial applications create strong demand. Ruthenium applications include electrical contacts and chip resistors. Iridium uses are critical in spark plugs, crucibles, and medical devices. The electronics industry PGM demand is particularly strong.

Both metals are excellent catalysts. This fuels significant catalyst demand. Investment demand also influences prices. Speculative buying can cause short-term fluctuations.

Industrial buyers seeking reliable PGM raw materials can explore comprehensive sourcing solutions. China Titanium Factory offers expert services to navigate these complex markets.

Ruthenium vs. Iridium: A Comparative Price Trend Analysis

A direct comparison of Ruthenium vs Iridium price trends is insightful. Both are PGMs, but their market dynamics can differ significantly. They share similarities in supply constraints. However, their primary demand drivers often diverge.

Ruthenium's market is smaller and less liquid. This can lead to greater price volatility comparison. Iridium, while also volatile, has broader industrial applications. This offers a slightly more diversified demand base. Understanding these nuances is vital for accurate PGM comparison.

For instance, Ruthenium's price surged due to demand for hard disk drives. Iridium's rise was linked to its use in specialized spark plugs and crucibles. These distinct demand drivers explain why their values sometimes diverge. At other times, broader PGM market sentiment causes them to move in tandem.

Future Forward: How Emerging Technologies Shape PGM Prices

New technologies will significantly impact future demand. This will affect Ruthenium price trend and Iridium market outlook. The hydrogen economy metals are gaining importance. Both metals play roles in advanced catalysts for hydrogen production and fuel cells.

Ruthenium is being explored for its role in green hydrogen production. Iridium is crucial for proton exchange membrane (PEM) electrolyzers. These are vital for producing hydrogen from water. Johnson Matthey's PGM Market Report often highlights these emerging applications.

Other innovative sectors also show promise. Emerging tech PGM demand includes quantum computing and advanced electronics. These applications could create new demand surges. This would further influence future precious metals prices.

Global Variations: Understanding Regional Price Discrepancies

Prices for Ruthenium and Iridium can vary globally. Several factors contribute to these price discrepancies metals. Local supply and demand dynamics are primary drivers. For example, regions with high electronics manufacturing might see higher local demand for Ruthenium.

Logistics costs are also significant. Transporting these rare metals involves specialized security and insurance. This adds to the final price. Taxation and import/export duties also impact international precious metals pricing. Regional market specificities, such as local regulations or dominant industries, also play a role.

Understanding these Regional PGM prices is crucial. It helps buyers and sellers make informed decisions. It also affects the overall Ruthenium global market and Iridium regional demand.

Navigating Volatility: Strategies for Investors and Buyers

Precious metals inherently carry volatility. This section provides insights into managing risks. It focuses on Ruthenium investment risk and Iridium trading strategies. Factors like supply shocks, sudden demand shifts, and speculative trading contribute to PGM price volatility.

Risk mitigation strategies include diversification. Long-term supply contracts can help industrial buyers. Hedging instruments also offer protection against price swings. Continuous market monitoring is essential for effective market risk management. For tailored advice on sourcing or risk, contact China Titanium Factory directly.

Frequently Asked Questions About PGM Price Swings

Common questions arise concerning PGM price volatility. These include inquiries about sudden price changes. Concerns about market manipulation also exist. The long-term PGM outlook for stability is a frequent topic. Addressing these helps in understanding price fluctuations better.

Looking Ahead: Future Price Outlook for Ruthenium and Iridium

The Ruthenium price forecast and Iridium market outlook remain dynamic. Current market trends suggest continued demand growth. This is particularly true for high-tech applications. Expert analyses point to ongoing volatility. However, long-term demand drivers appear robust.

Emerging technological developments are key. The expansion of the hydrogen economy will boost demand. Advanced catalysts and electronics will also contribute. These factors support a positive long-term trajectory for future precious metals prices. However, supply risks persist. S&P Global provides regular market projections for PGMs.

Investors and industrial users must stay informed. Continuous evaluation of market conditions is critical. This helps in making strategic decisions.

Essential Tools and Resources for PGM Market Analysis

Access to reliable data is paramount. Various tools and resources aid in tracking PGM market data. Real-time data platforms offer up-to-the-minute price information. Specialized price tracking software can monitor multiple metals.

Comprehensive market reports provide in-depth analysis. These reports detail supply, demand, and geopolitical factors. Explanatory videos and interactive price calculators can also be valuable. Such investment resources help in decision-making. For further market analysis platforms and insights, explore the China Titanium Factory blog.

The Evolving Landscape of Ruthenium and Iridium Prices

The Ruthenium market summary and Iridium insights highlight their dynamic nature. These PGMs are crucial for global economy and technological advancement. Their markets are characterized by limited supply. They also have highly specialized, growing demand.

Understanding their price trends requires continuous attention. It involves analyzing supply chain vulnerabilities. It also means tracking industrial innovation. For reliable sourcing and deep market understanding, learn more about China Titanium Factory's expertise in precious metals.

The future of PGMs depends on these intertwined factors. Staying informed is essential for all market participants.

Frequently Asked Questions

What causes sudden price changes in Ruthenium and Iridium?

Sudden price changes often stem from supply disruptions. These include mining strikes, political instability in producing regions, or logistical challenges. Unexpected surges in industrial demand, especially from new technological applications, can also cause rapid price shifts. Additionally, speculative trading can amplify these movements.

Are Ruthenium and Iridium prices susceptible to market manipulation?

Due to their relatively small market size and low liquidity compared to major commodities, Ruthenium and Iridium prices can be more susceptible to significant movements from large trades or concentrated buying/selling. While direct manipulation is illegal, market dynamics can be heavily influenced by a few key players or large-scale industrial procurement.

What is the long-term outlook for Ruthenium and Iridium price stability?

The long-term outlook suggests continued price volatility. This is due to inherent supply constraints and niche demand drivers. However, growing adoption in emerging technologies like the hydrogen economy and advanced electronics provides strong underlying support for demand. This could lead to periods of sustained price appreciation, despite short-term fluctuations.

How do geopolitical events affect PGM prices?

Geopolitical events, particularly in major PGM-producing nations like South Africa or Russia, can severely impact supply. This can lead to production halts, export restrictions, or increased costs. Such disruptions directly reduce available supply, often causing immediate and significant price increases for Ruthenium and Iridium.

Secure Your Supply of Critical Materials

Navigate the volatile precious metals market with confidence. China Titanium Factory offers expert sourcing and strategic insights for your industrial needs. Partner with a leader in raw material procurement.

Get Expert Sourcing Assistance →